I'm definitely not an economist and tend to struggle with understanding our current global financial system. But its important that we grasp some basics so that when questions come up, we're prepared to address them.

Steve Benen has a great column up this morning putting it all into perspective. He points out that most often when we evaluate how we're doing, we compare things like unemployment to what happened during previous U.S. recessions. I expect that, like me, you've seen this chart showing that comparison going back through all recessions since WWII.

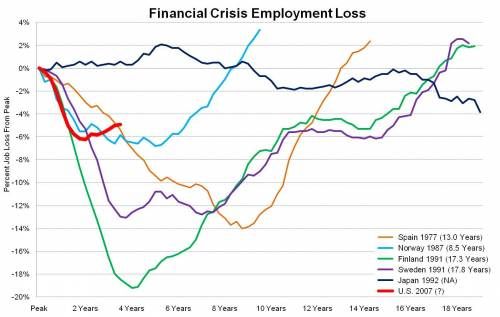

The red line represents our employment situation during this most recent recession. Looking at that comparison, this one was much worse and the recovery is anemic at best.

But what that doesn't take into account is that this recession was caused by the collapse of the financial industry. And the only other time the U.S. has experienced that - it led to the Great Depression.

Back in 2009 economists Carmen Reinhart and Kenneth Rogoff completed a study of financial crises in 66 countries over 8 centuries, documenting how they happen and the similarities between them.

And this week, the Oregon Office of Economic Analysis updated their information on recovery patterns with what has happened in the U.S. over the last two years. Here's how it looks (once again, the red line represents the current U.S. situation):

According to this data, the U.S. is doing better than almost any other country when it comes to employment following a financial crisis. As Benen points out - that's cold comfort to those who are unemployed.

But it does beg the question of "what is working?" Those are the questions posed from this analysis by the Oregon Office of Economic Analysis:

The question that naturally follows and is not answered here is why does the current U.S. cycle measure up in terms of the aftermath of financial crises except in the percentage of employment loss? Relative to Spain, Norway, Finland and Sweden, it appears that the U.S. did something right. Is it as simple as ARRA? Is it TARP and the backstopping of the financial industry? Is it the fact that, more or less, the world had a coordinated response in late 2008/early 2009 for expansionary fiscal and monetary policies?(Emphasis mine)

From this non-economists perspective, it was the policies of de-regulation that got us into this mess. Now Republicans want to try to convince us that more of that will get us out of it. That's absurd on its face.

Meanwhile, it also seems clear to me that government intervention via stimulus, TARP, auto bailouts, etc. have at least helped us begin to improve things faster than other countries have been able to climb out of similar recessions. So we should be doing MORE of that kind of thing.

I know that's an uphill battle of an argument to make with American voters because we are an impatient people who are used to instant gratification. But that's reality and we need to do our best to explain it - at least to folks who are willing to listen.

No comments:

Post a Comment